Blog Articles

Why A Non-QM Loans Might Be For You

Posted on

Are you a self-employed borrower? Do you own your own business, and have maybe struggled to obtain financing?

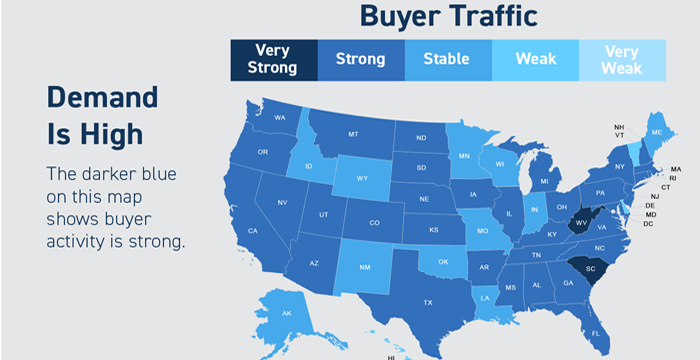

Read MoreHousing market reaches a turning point in 2022

Posted on

There’s no denying the housing market has delivered a fair share of challenges to homebuyers over the

Read MoreNJ Lenders Corp. named #1 on New Jersey’s Top Workplaces list

Posted on

Employee engagement platform, Energage, names NJ Lenders Corp. as #1 midsize company on New Jersey’s

Read MoreMedical debt to be excluded from millions of credit reports

Posted on

The three credit bureaus, Equifax, Experian, and TransUnion, announced that millions of U.S. consumers will

Read MoreWhat You Need To Budget for When Buying a Home

Posted on

When it comes tobuying a home, it can feel a bit intimidating to know how much you need to

Read More3 Ways to Cancel Private Mortgage Insurance (PMI) on a Conventional Loan

Posted on

Designed to protect lenders if a borrower stops making payments on their loan, private mortgage insurance

Read MoreThe Average Homeowner Gained More Than $55K in Equity over the Past Year

Posted on

If you’re a current homeowner, you should know your net worth just got a big boost. It comes in

Read MoreUsing Crypto to Buy a Home: Everything You Need to Know

Posted on

Cryptocurrency continues to gain popularity as an investment vehicle, as well as a means of payment for goods

Read MoreDebunking 5 Common Credit Inquiry Myths

Posted on

Paying down your debts or generating more income are practical ways to improve your DTI ratio. Always speak with your trusted mortgage advisor to find solutions for improving your DTI ratio as well as your credit score.

Read More2022 Tax Season Checklist: What Homeowners Should Gather Before Filing

Posted on

Even though taxes aren’t due until April 18, 2022, it pays to get organized. Tax filing season began on

Read MoreGetting a Mortgage for Self-Employed Borrowers is Easier Than Ever

Posted on

Buying a home just became easier for self-employed borrowers. When COVID-19 first began,

Read MoreThe Gift Tax Myth: How it Impacts You

Posted on

HOW DOES THE GIFT TAX WORK WHEN USING GIFT FUNDS TO BUY A HOME? 1 $16,000 ANNUAL EXCLUSION The federal

Read MoreFannie Mae Releases New Requirements for Condos in 2022

Posted on

Beginning January 1, 2022, Fannie Mae is taking a stronger look at condos after releasing requirements that

Read MorePros and Cons of Waiving an Appraisal When Buying a Home

Posted on

Lenders are touting to realtors and borrowers that they do not require an appraisal in order to approve and

Read More